ON THE RECORD. . .

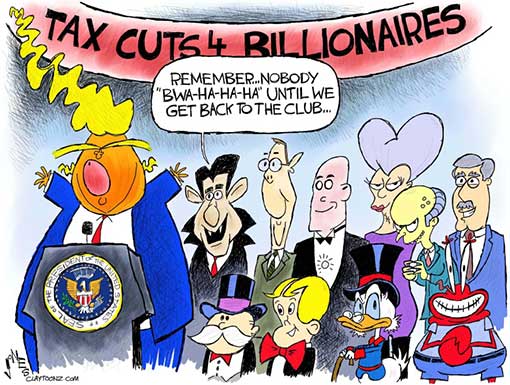

“You all just got a lot richer,” -- Trump to friends dining at his exclusive Mar-a-Lago club.

“Haiti had sent 15,000 people. They ‘all have AIDS ... Forty thousand had come from Nigeria. Once they had seen the United States, they would never ‘go back to their huts’ in Africa, recalled the two officials, who asked for anonymity to discuss a sensitive conversation in the Oval Office.” -- Donald Trump

"As I leave the Senate, I have to admit that it feels like we’re losing the war for truth. Maybe it’s already lost. If that’s what happens, then we have lost the ability to have the kinds of arguments that help build consensus.” — Sen. Al Franken (D-MN), quoted by the Washington Post, in his final speech on the Senate floor.

Trump Admin threat to retaliate against nations that exercise sovereign right in UN to oppose US position on Jerusalem is beyond outrageous. Shows @realDonaldTrump expects blind loyalty and subservience from everyone—qualities usually found in narcissistic, vengeful autocrats. -- Former CIA Director John O. Brennan✔@JohnBrennan

Q: Do you blame Steve Bannon for Doug Jones being elected in Alabama?

Sen. McConnell: "Well let me just say this: The political genius on display throwing away a seat in the reddest state in America is hard to ignore." -- NBC News✔@NBCNews

“When you look at some of the audiences cheering for Republicans sometimes, you look out there and you say, ‘Those are the spasms of a dying party.’ By and large, we’re appealing to older white men, and there are just a limited number of them.” — Sen. Jeff Flake (R-AZ)

“It’s true, they haven’t started World War III yet. That’s a pretty low bar.” — Former Bush national security aide Eliot Cohen on the Trump administration.

The Affordable Care Act has faced two Supreme Court near-death experiences, eight years of Republican misinformation, multiple repeal efforts, and now a year of the Trump administration’s sustained sabotage. After all that, Obamacare has taken more than its share of blows. But it is very much still standing. -- Benjamin Hart in NY Magazine

IN THIS ISSUE

FYI

OPINION

| FYI |

1. Years of Attack Leave Obamacare a More Government-Focused Health Law

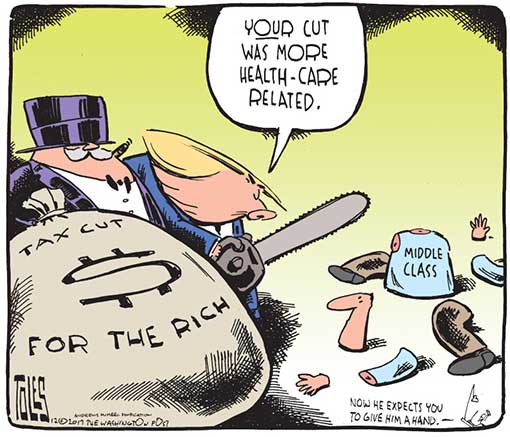

The Affordable Care Act was conceived as a mix of publicly funded health care and privately purchased insurance, but Republican attacks, culminating this month in the death of a mandate that most Americans have insurance, are shifting the balance, giving the government a larger role than Democrats ever anticipated.

And while President Trump insisted again on Tuesday that the health law was “essentially” being repealed, what remains of it appears relatively stable and increasingly government-funded.

In short, President Barack Obama’s signature domestic achievement is becoming more like what conservatives despise — government-run health care — thanks in part to Republican efforts that are raising premiums for people without government assistance and allowing them to skirt coverage. https://www.nytimes.com/2017/12/26/us/politics/republicans-trump-affordable-care-act-obamacare.html

2. Democrats Leave Few Seats Unchallenged in Quest for House Control

Federal Election Commission filings show that if a wave crashes on the Republican House majority in November, as many have predicted, Democratic surfers will be on their boards to catch it. Nearly a year out from the election, Democratic candidates have filed in all but 20 House districts held by Republicans. By comparison, Democrats in 80 districts do not have a Republican opponent for their seat.

The Democrats are not just filing to run in districts where Mrs. Clinton performed well. They are also running for conservative seats that were uncontested in 2016 and where Republicans remain heavy favorites, in states like Texas, Arkansas and Nebraska. https://www.nytimes.com/2017/12/24/us/democrats-house-control-2018-midterms.html

3. Russian Trolls Went on Attack During Key Election Moments

Thousands of Russian trolls targeted national events during the 2016 U.S. presidential election to infiltrate the online conversations of millions of Americans,” according to a new analysis of a database of recovered troll tweets by NBC News.

The records show how digital communications tools invented by U.S. companies, such as Twitter and Facebook, were instead exploited by the Kremlin-backed agents to promote autocracy and fear. https://www.nbcnews.com/tech/social-media/russian-trolls-went-attack-during-key-election-moments-n827176

4. The DAILY GRILL

How can FBI Deputy Director Andrew McCabe, the man in charge, along with leakin’ James Comey, of the Phony Hillary Clinton investigation (including her 33,000 illegally deleted emails) be given $700,000 for wife’s campaign by Clinton Puppets during investigation? -- Donald J. Trump✔@realDonaldTrump

VERSUS

McCabe's wife, Jill, did not get $700,000 in donations from Clinton for a Virginia state Senate race in 2015. The money came from Virginia Gov. Terry McAuliffe's political action committee and the Virginia Democratic Party and was donated before McCabe was promoted to deputy director and assumed a supervisory role in the Clinton email investigation. -- LA Times

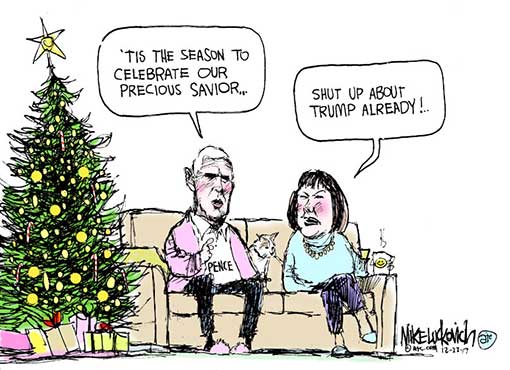

I hope everyone is having a great Christmas, then tomorrow it’s back to work in order to Make America Great Again (which is happening faster than anyone anticipated)! -- Donald J. Trump✔@realDonaldTrump Dec 25th.

VERSUS

But it appears Trump either operates with an unusual concept of “work,” or was lying. Because Trump began the following morning by live-tweeting his favorite show, Fox & Friends — a show he regularly reacts to on Twitter, despite his recent proclamation that he does “not watch much television.” After watching some TV, Trump headed to his Trump International Golf Club, where he was caught on camera playing golf at one of his golf courses for the 85th visit since taking office less than a year ago. Then, on Wednesday morning, Trump headed back to the Trump International Golf Club for his 86th visit to one of his golf courses since taking office. -- Think Progress

5. Blue Wave Is Forming

Live interview generic ballot polls in December:

CNN D+18

Quinnipiac D+15

Monmouth D+15

Marist D+13

POS (R) D+12

NBC/WSJ D+11

https://twitter.com/Nate_Cohn/status/943530754881015808

6. From MEDIA MATTERS (They watch Fox News so you don't have to)

Fox & Friends floats cutting off American foreign aid to some countries to fund Trump's border wall. Brian Kilmeade: "It would be interesting if the president decided ... to shave off let's say $2 billion and just say, 'I'm going to start the border wall. I'm going to punish the world.'" https://www.mediamatters.org/video/2017/12/22/Fox---Friends-floats-cutting-off-American-forigen-aid-to-some-countries-to-fund-Trumps-bor/218938

Study: Trump officials appeared on Fox News over 5 times more often than on CNN and MSNBC combined. https://www.mediamatters.org/research/2017/12/22/Study-Trump-officials-appeared-on-Fox-News-over-5-times-more-often-than-on-CNN-and-MSNBC-c/218931

Cable news networks forgot Trump sexually assaulted women, until the Harvey Weinstein stories broke. Evening programming on Fox News, CNN, and MSNBC all devoted much more time to the allegations against Trump after The New York Times reported on Harvey Weinstein’s sexual misconduct. https://www.mediamatters.org/blog/2017/12/21/cable-news-networks-forgot-trump-sexually-assaulted-women-until-harvey-weinstein-stories-broke/218916

Alex Jones and Roger Stone visited a gun range to prepare for civil war if Trump is removed from office. https://www.mediamatters.org/blog/2017/12/21/alex-jones-and-roger-stone-visited-gun-range-prepare-civil-war-if-trump-removed-office/218934

Breitbart editor suggests there is a "correlation between Islam and mental health." VIDEO: https://www.mediamatters.org/video/2017/12/22/brietbart-editor-suggests-there-correlation-between-islam-and-mental-health/218941

7. From the Late Shows

Full Frontal with Samantha Bee: Fox & Friends: https://www.youtube.com/watch?v=WjHjXOH9XJk

Stephen Reacts To Trump Calling Him 'A No-Talent Guy' May 12, 2017 https://youtu.be/_wMvItIDMPU

8. Late Night Jokes for Dems

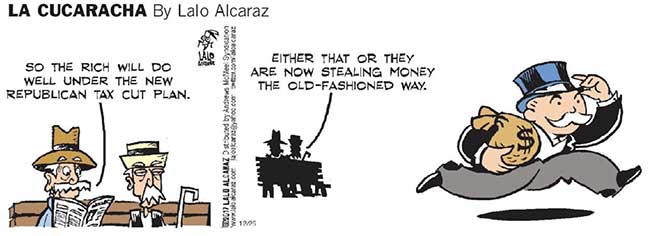

The House passed a Republican tax bill today, which was great news for everyone from the super wealthy all the way down to the that's it. -- Seth Meyers

President Trump today denied a Washington Post report that he was considering rescinding his nomination of Supreme Court justice Neil Gorsuch. Prior to his confirmation, calling it, you guessed it, fake news. Hey, man, you're burning out your own catch phrase. Pretty soon you're going to need a new catch phrase, like "It's golfing time." Or "I hereby resign from the presidency of the United States." Oh, that's catchy. -- Seth Meyers

I read that a majority of Americans would end up paying more in taxes by the year 2027. Trump said its payback for the majority of Americans who voted for Hillary Clinton. -- Jimmy Fallon

Yeah, a lot of people are upset. In fact, I read that a woman took her top off in the House while protesting the vote. Security escorted her out, while Trump said, "Let's hear what she has to say!" -- Jimmy Fallon

President Trump had a very good day. He’s very proud – Republicans finally passed his tax bill which means Trump’s about to sign his first major piece of legislation. Yep, his chest was puffed out so far his tie was actually at a normal length. “Wow! It’s actually at my waist!” -- Jimmy Fallon

There’s been a lot of criticism. I read that only 24 percent of Americans think the GOP tax plan is “good.” To put that in perspective, The Spice Girls movie got a 29 percent score on Rotten Tomatoes. -- Jimmy Fallon

House Minority Leader Nancy Pelosi said that the tax plan is "an all-out looting of America, a wholesale robbery of the middle class." Which incidentally, is also the slogan for Whole Foods. -- Jimmy Fallon

The University of Pennsylvania, which is Trump’s alma mater, says the tax bill will add 2.2 trillion dollars to the national debt. Trump was like, "Come on - are you really gonna believe a school that let ME graduate? Gimme a break!” -- Jimmy Fallon

9. Senior White House adviser at Homeland Security repeatedly promoted fringe conspiracy theories on the radio

A KFile review of more than 40 hours of Senior White House Advisor to the Department of Homeland Security Frank Wuco’s radio appearances shows he regularly promoted unfounded conspiracy theories that have been spread by members of the far right over the years. Among the conspiracy theories Wuco pushed were claims that former President Barack Obama’s memoir was ghost written by former anti-Vietnam War radical Bill Ayers, claims that former CIA director John Brennan converted to Islam and claims Attorney General Eric Holder had been a member of the Black Panthers.

KFile previously reported Wuco pushed false claims during radio appearances that Obama was not born in the US, made disparaging comments about the LGBT community, and lamented what he called the "Zimbabwe-fication" of America. http://edition.cnn.com/2017/12/20/politics/kfile-frank-wuco-conspiracy-theories/index.html

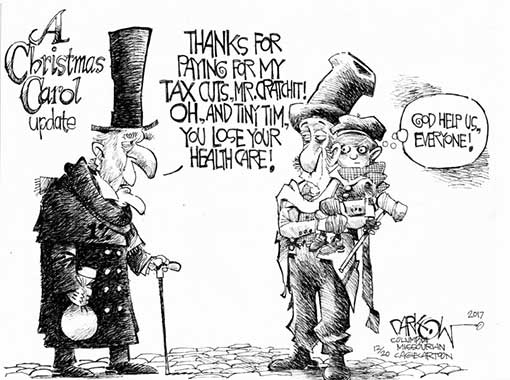

10. One potential loser in the new GOP tax bill: Puerto Rico

Puerto Rico’s governor is warning that the sweeping tax plan passed by congressional Republicans on Wednesday could deliver a ‘crippling blow’ to the island’s already-fragile economy, still reeling from the effects of major hurricanes.

The tax bill passed overwhelmingly in the House on Wednesday includes a new 12.5 percent tax on profits derived from intellectual property held by foreign companies — a move designed to compel those companies to move back to the United States. Puerto Rico is considered part of the United States in all realms except taxes — meaning that island residents don’t pay federal income taxes but do pay into Social Security. Companies based on the island are treated as if they were located in other Caribbean tax havens not under an American flag. https://www.washingtonpost.com/powerpost/one-potential-loser-in-the-new-gop-tax-bill-puerto-rico/2017/12/20/cdf4324a-e5c9-11e7-a65d-1ac0fd7f097e_story.html

11. History Suggests Tax Celebration Will Be Short-Lived

Bookmark that photo of Republican lawmakers gathering at the White House today to celebrate their first major legislative victory of the Trump era. If history is any guide, many of them may be on their way out this time next year.

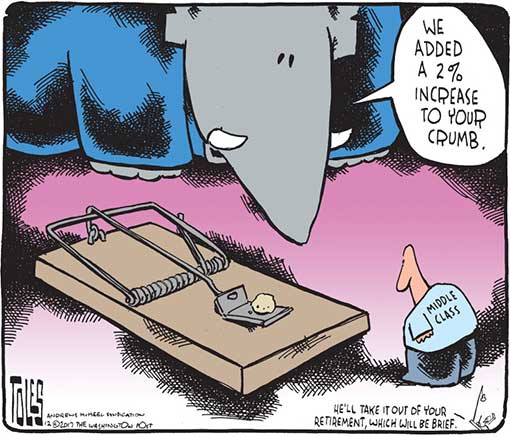

As others have documented, including Harry Enten at 538, the just-passed tax reform bill starts out life as the least popular tax legislation going back to at least 1981. Tax HIKES in 1990 and 1993 got better reviews. For the record, the Monmouth University Poll puts public opinion of the current package at 26% approve and 47% disapprove.

Polling shows that the public feels the package was mainly designed to benefit the wealthy rather than the middle class. Republicans, and Pres. Trump in particular, currently suffer a credibility deficit with the middle class. Based on Trump’s rhetoric that he would put average Americans first, fully 66% of the public believed when he took office that the middle class would benefit from a Trump administration. That opinion has flipped. Currently, a majority of 53% say that middle class families have seen no benefit at all from the president’s policies to date.

Importantly, fully half of the American public believes that their own federal taxes will increase because of this new tax reform package. Only 14% expect that their taxes will go down. In reality, many more than 1-in-7 taxpayers will see at least a nominal decrease. This reality is what GOP lawmakers are banking on when they face the voters next year. https://monmouthpoll.blogspot.com/2017/12/history-suggests-gop-tax-reform.html

12. More than 4 in 5 enrolled in 'Obamacare' are in Trump states

Americans in states that Donald Trump carried in his march to the White House account for more than 4 in 5 of those signed up for coverage under the health care law the president still wants to take down.

An Associated Press analysis of new figures from the government found that 7.3 million of the 8.8 million consumers signed up so far for next year come from states Trump won in the 2016 presidential election. The four states with the highest number of sign-ups — Florida, Texas, North Carolina and Georgia, accounting for nearly 3.9 million customers — were all Trump states. http://abcnews.go.com/Health/wireStory/enrolled-obamacare-trump-states-51958050

| OPINION |

1. John Cassidy: The Final Version of the G.O.P. Tax Bill Is a Corrupt, Cruel, Budget-Busting Hairball

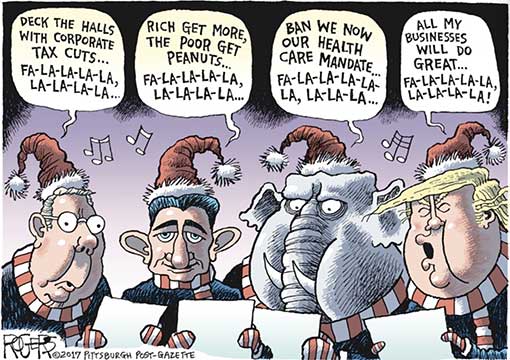

It is hardly surprising that Republicans don’t want to give anyone too much time to look closely at their latest handiwork. The final tax bill is the product of a conference committee that was tasked with reconciling the different bills passed in the House and the Senate. Almost eleven hundred pages long, the final bill is just as regressive and fiscally irresponsible as either of the two earlier bills, and it is arguably more so. At its center is a huge tax cut for corporations and unincorporated business partnerships—such as the ones that Donald Trump owns—while arrayed around the edges are all sorts of carve-outs and giveaways to favored industries and interest groups.

Nowhere to be found in the bill are three elements that House Speaker Paul Ryan, Senate Majority Leader Mitch McConnell, and their colleagues originally promised to deliver when they urged the American public to embrace tax reform: revenue neutrality, simplicity, and fairness. The final bill is a corrupt, budget-busting hairball.

According to its authors, the bill will increase the budget deficit by about $1.5 trillion over ten years. That’s a lot of money, obviously, but it’s an underestimate. If you adjust the numbers for a series of accounting gimmicks, such as expiration provisions that are unlikely to go into effect, the real cost seems likely to come out at more than two trillion dollars. https://www.newyorker.com/news/our-columnists/the-final-version-of-the-gop-tax-bill-is-a-corrupt-cruel-budget-busting-hairball

2. Eugene Robinson: This tax deal is great for Trump. What a coincidence!

One of the biggest beneficiaries of the massive, slapdash tax bill that President Trump and Republican lawmakers celebrated at the White House on Wednesday will be, wait for it . . . President Trump. What a coincidence!

The rest of Trump’s wealthy family will benefit lavishly as well, including his son-in-law and all-purpose adviser, Jared Kushner. And, of course, it’s not a coincidence at all. The chance that this president would preside over a revision of the tax code without lining his own pockets was zero. Anyone who believed Trump’s claim that the tax bill would “cost me a fortune” hasn’t been paying attention.

It is not possible to calculate precisely how much money the president will save, because he — unlike all other recent presidents — refuses to release his tax returns. But the figure is surely in the millions, assuming Trump is anywhere near as wealthy as he claims. His extended clan will have plenty of liquidity for Donald Jr. and Eric to jet off to Africa and kill more leopards and water buffaloes; for Jared and Ivanka to disappear on ski trips whenever they need to claim deniability regarding the latest administration outrage; and for the president himself to consume as many Big Macs, Filet-o-Fishes and chocolate shakes as his constitution can bear.

Join me in a thought experiment. Imagine that the legislature of some other country — Brazil, say, or Mozambique, or Thailand — decided to rewrite the tax code, with no public hearings or expert testimony, in a way that benefited the rich overall, with maximum financial gain for businesses like that of the sitting head of government. What would you say?

I’m pretty sure you’d use the word corruption. And you would be right. https://www.washingtonpost.com/opinions/a-sweetheart-tax-deal--for-the-trumps/2017/12/21/17546880-e68b-11e7-ab50-621fe0588340_story.html

3. Paul Krugman: Tax-Cut Santa Is Coming to Town

It’s that time of year again. Some of us will get nice gifts, while others will get lumps of coal.

The centerpiece of the Republican tax cut legislation is a huge tax cut for corporations. Republicans claim that this tax cut will be passed on to workers in the form of higher wages, but most independent studies conclude that even in the long run only between one-fifth and one-quarter of the tax cut will trickle down to workers. And the fraction will be much lower in the short run — say, the next few years. So this is basically a tax cut for shareholders.

And who are these shareholders? About a third of the total benefits will go to foreigners. Among U.S. residents, while many people have some stock in their retirement accounts, those amounts are generally small. Even including indirect holdings through mutual funds, the top 1 percent of domestic households owns 40 percent of stocks, the bottom 80 percent just 7 percent. So when Tax-Cut Santa comes to town, it’s definitely good to be rich.

You see, the second most important piece of this tax bill, after the corporate tax giveaway, is a drastic tax cut for business owners, who will end up paying much less in taxes than people with the same income who work as someone else’s employee.

It’s hard to come up with any good rationale for this move, which will discriminate among taxpayers in a way that bears no relationship to any coherent policy goal. It will, however, offer a big financial windfall to a number of elected officials, especially Donald Trump.

And what about those promises that rich people wouldn’t get a tax cut, that the tax system would get simpler, that you’d be able to file on a postcard, and all that? All I can say is, ho ho ho. https://www.nytimes.com/2017/12/21/opinion/tax-cut-santa.html

4. Dean Obeidallah: Trump and the GOP Just Ensured That the 2018 Blue Wave Will Be Yuuuge

There’s one glaring difference from the 2010 election: Donald J. Trump. People hate him. And not just in a political sense--but personally. That’s why despite a very solid economy Trump is ending his first year far and away the most unpopular president in the polling era at the same point in his presidency. Per recent polls, only 34 percent believe Trump is honest, only 37 percent believe he cares about the average American and only 32 percent believe he shares their values. And people are seeing through Trump’s recent lie that he will personally pay more under the GOP tax plan as evidenced by two thirds of Americans saying they believe the GOP tax cut will enrich him and his family.

So Trump can offer us all the crumbs he wants from his tax plan for the wealthy but it won’t make up for his trafficking in hate to win his election, his defending of white supremacists, his non-stop lying, his sexual misconduct, his shaming of victims he assaulted and the like. Americans clearly are not forgiving Trump for this history, and nor should they.

Anger makes people come out and vote in midterms, and I can assure you the fury toward Trump is palpable and runs deep. And it’s growing more intense thanks to the unfairness of the GOP tax cuts. If all those who oppose Trump’s history of hate and his policies turn out to vote in November – just as we saw in the recent elections in Virginia and Alabama – Democrats will ride a beautiful, massive blue wave that will wash the Republicans from Congress. And from there, the hope is either via impeachment or another massive blue wave in 2020, we can then sweep Trump out of the White House and back into oblivion where he belongs. https://www.thedailybeast.com/trump-and-the-gop-just-ensured-that-the-2018-blue-wave-will-be-yuuuge

5. Paul Waldman: The GOP's reality problem

This is one area where the Trump administration is no different than any other Republican administration: They're going to grouse about the media no matter what happens. And while even Democratic presidents say they aren't covered fairly, the complaint serves different purposes for Republicans.

While liberals have many complaints about how the news media does its job, the liberal critique of the news plays nothing like the central role within their movement that the conservative critique does in theirs. In part it's because of the power of simplicity. Liberals have a complex set of criticisms they make about the press, but conservatives have only one: "liberal bias." It doesn't have to be explained, and it can be applied to literally any issue. No matter what the topic of the moment is — an election campaign, a policy debate, a scandal — conservatives will always charge that the media is being biased against them. The charge feeds their base's finely honed sense of grievance, inoculates that base against uncomfortable facts, and keeps journalists under constant pressure to move coverage in a direction more friendly to Republicans.

But if Sarah Sanders believes that the press has taken an even more skeptical stance toward this administration than it has toward previous ones, she's right. There's a simple reason for that: There's never been a president or an administration that lies in such spectacular volume or with such mind-boggling shamelessness as this one.

To take just one example, if you're a reporter and Sanders looks you in the eye and tells you that Trump will pay more in taxes as a result of this bill, what are you supposed to say about that? While we don't know exactly how big a tax cut Trump will get because he refuses to release his tax returns, we absolutely know that he's getting a cut. He'll benefit not only from the reduction in the top rate, but mostly from the gigantic "pass-through" loophole the bill opens up (the Trump Organization is essentially a collection of hundreds of pass-through entities). The only question is whether the bill is worth millions of dollars, tens of millions of dollars, or hundreds of millions of dollars to Trump. http://theweek.com/articles/744410/gops-reality-problem

6. Steve Coll: The Distrust That Trump Relies Upon

Even in a stable constitutional republic, a cynical or unmoored citizenry presents an opportunity for demagogues and populists. As much as stagnant wages in former manufacturing regions, glaring economic inequality, or white backlash after the Obama Presidency, the country’s disillusionment with institutions enabled Donald Trump’s election. Trump had a sound instinct as he took office that public disgust with élites, including those running the Republican Party, ran so deep that he—even as a New York billionaire—could get away with outrageous attacks on people or agencies previously believed to be off limits for a President, because of the political backlash that the attacks would generate. After his Inauguration, for example, Trump did not hesitate to denigrate the C.I.A. and other intelligence agencies for promoting their independent judgment that Russia had sought to aid his campaign. And the President’s opportunistic assaults on less popular institutions—such as the news media and Congress—have riled his base.

All this suggests the need for a certain realism and vigilance about the rising volume of attacks by Trump and his allies on Robert Mueller, the special counsel leading the investigation into possible Russian interference in the election and (increasingly) related issues, and on the F.B.I., whose agents carry out much of the investigative work. Presidents Nixon, Reagan, and Clinton all denigrated the counsels who investigated them. Nixon went so far as to fire some of those he saw as his tormentors, in the infamous Saturday Night Massacre. Judging by the indictments of certain Trump associates, such as his former campaign chairman Paul Manafort, and the coöperation agreements by others, notably Michael Flynn, his former national-security adviser, it is conceivable that during the next year Trump will face a choice between radical action—issuing preëmptive pardons, firing Mueller or the Deputy Attorney General Rod Rosenstein—and allowing someone close to him, perhaps even a family member, to face criminal charges. It is hard to imagine him reacting to that dilemma with care or caution. https://www.newyorker.com/news/daily-comment/the-distrust-that-trump-relies-upon

7. Susan Milligan: Ignoring the Will of the People

The $1.5 trillion tax bill, hailed with glee and relief by Republicans eager to appease donors and desperate for the year's first major legislative win, is the most unpopular major piece of legislation to pass in decades.

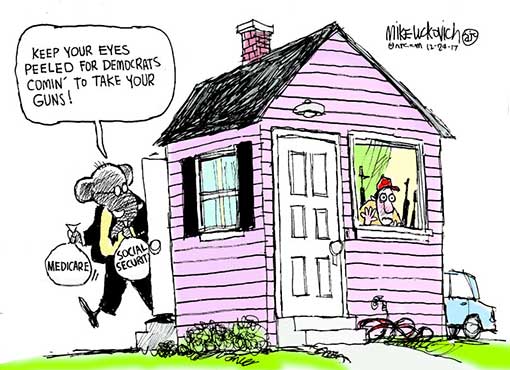

That may sound remarkable, but it's not the only case where public opinion – exhaustively collected, analyzed and reported by pollsters, interest groups and political parties – appears to have had little impact on a matter of public interest. President Barack Obama's Deferred Access for Childhood Arrivals program to allow certain young immigrants to stay in the country is also overwhelmingly approved of by the electorate. But Congress failed to codify that program as it prepared to wind up for the year. Background checks for gun buyers, too, enjoys widespread public approval, polls consistently show – but that idea, too, never manages to get enough votes for passage.

So what's the congressional calculation? Do they not trust the polls, or care what Americans think? Lawmakers do indeed care, pollsters and political analysts say. They just care more about what certain people think and want.

As for the tax bill, "the Republicans are betting that by the time people realize what a turkey this bill is, it will be somebody else's problem,". And that problem may be dumped onto the tax bill-hating Democrats, should they succeed in wresting control of Congress. -- Stan Collender, executive vice president at Qorvis MSLGROUP and a leading expert on the federal budget and taxes says. https://www.usnews.com/news/the-report/articles/2017-12-22/why-the-wildly-unpopular-tax-bill-passed

8. Eugene Robinson: Trump’s First Year Was Even Worse Than Feared

Grit your teeth. Persevere. Just a few more days and this awful, rotten, no-good, ridiculous, rancorous, sordid, disgraceful year in the civic life of our nation will be over. Here’s hoping that we all — particularly special counsel Robert S. Mueller III — have a better 2018.

Many of us began 2017 with the consoling thought that the Donald Trump presidency couldn’t possibly be as bad as we feared. It turned out to be worse.

Did you ever think you would hear a president use the words “very fine people” to describe participants in a torch-lit rally organized by white supremacists, neo-Nazis and the Ku Klux Klan? Did you ever think you would hear a U.S. ambassador to the United Nations thuggishly threaten that she would be “taking names” of countries that did not vote on a General Assembly resolution the way she wanted? Did you ever think the government of the world’s biggest military and economic power would reject not just science but also empiricism itself, preferring to use made-up “alternative facts” as the basis for major decisions?

We knew that Trump was narcissistic and shallow, but on Inauguration Day it was possible to at least hope he was self-aware enough to understand the weight that now rested on his shoulders, and perhaps grow into the job. He did not. If anything, he has gotten worse. https://www.washingtonpost.com/opinions/trumps-first-year-was-even-worse-than-feared/2017/12/25/b0991572-e753-11e7-ab50-621fe0588340_story.html